If you’re aged 39 to 54 you’re unlikely to have seen your Financial Adviser last year – only 8% of people in this age bracket did according to a recent Money Marketing report.

If you’re aged 39 to 54 you’re unlikely to have seen your Financial Adviser last year – only 8% of people in this age bracket did according to a recent Money Marketing report.

Nestled between the ‘never had it so good’ Baby Boomers and the social media-savvy Millennials, if you’re a member of Generation X – born between 1965 and 1979 – you’ll be giving increasing amounts of thought to your retirement. This is a life milestone and an important time to seek advice.

The same Money Marketing report suggests that 29% have ‘never paid more than the original minimum default contribution’ through auto-enrolment and that the ‘average pension savings of UK Generation Xers is £159,837, putting in just over £200 per month’. But is this enough?

Here are some things to consider when contemplating your future retirement.

1. Revisit your retirement plan

Having a retirement plan in place is great but revisiting it – to check on the size of your pension pot, factor in a change of circumstance, or make changes to investments – is also important.

Think about the retirement date you’re currently working towards and ask yourself these questions:

- When do you plan to retire, and when can you retire?

- What type of retirement do you want and how expensive is it?

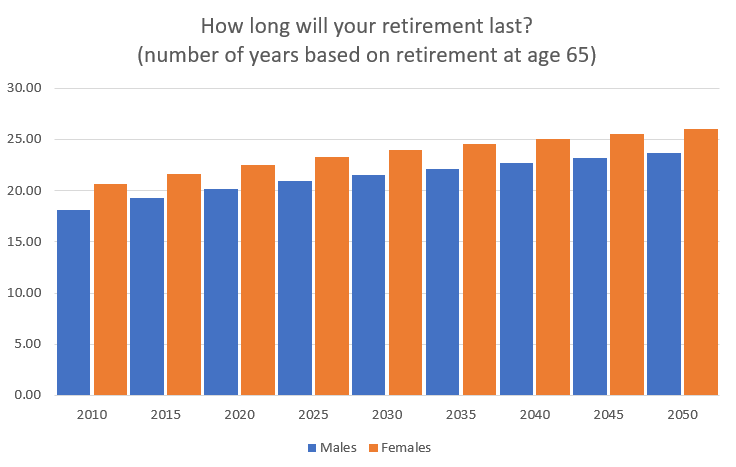

- How much money do you have and how long will it need to last?

You might have chosen a date already. It will be based on when you’d like to retire and when you can financially afford to, but circumstances can change, and it’s important that a financial plan change with them.

You might have been looking at a cliff-edge retirement – full-time work straight to full-time retirement. A redundancy payout or sudden inheritance might push the date forward, whereas the cost of a divorce or providing financial help to a child looking to get on the housing ladder might see you push the date back.

Whether you plan to travel the world or stay at home and spend more time with the grandkids, the money you take into retirement might need to last another 25 years.

Crucial to any retirement plan is an idea of how you would like to take your retirement benefits – as a lump sum, as regular income or a combination of options.

According to Money Marketing, ‘48% of female and 34% of male Generation Xers had never heard of Pension Freedoms. A further 30% had heard of them but knew nothing about them.’

Understanding your retirement options is crucial. If you need help with your retirement planning or want to know more about your available options, contact us.

2. Make the most of your earnings

As your retirement edges closer you might find that your salary is increasing. Whether you have identified a possible pension shortfall or find yourself with disposable income to invest, making the most of these last years of work could have a big impact on your pension pot at retirement.

- Top up your pension

According to Money Marketing, the average pension pot is £186,611 for Generation X men, while their female counterparts have £117,854. The average Generation X man ‘pays £253 each month into their pension; the average woman only half as much – just £139 per month.’

If you’re concerned about the size of your pension pot, consider topping up your pension.

The current Annual Allowance is £40,000 or 100% of your earnings – this is the amount you can contribute to a pension and benefit from tax relief. The allowance is across all schemes and includes contributions made by your employer and any third parties.

- Make voluntary National Insurance Contributions

Also, be sure to check in on your State Pension. From 6 April 2020, the new State Pension is £175.20 per week.

If you have gaps in your NICs, you may not receive the full State Pension. You can request a forecast to find out exactly how much your State Pension will be when you retire.

If you have gaps, now’s a good time to start making voluntary Class 3 contributions to fill the gaps in your contribution record.

- Top up your ISA

You might also consider making the most of the annual ISA allowance.

The ISA Allowance currently stands at £20,000. This is the amount you can invest into an ISA each year and, if you can make full use of your allowance in the years leading up to your retirement, you’ll give yourself a potential additional source of retirement income.

3. Seek advice

You’ll likely have a retirement plan in place, but it’s worth revisiting it as your retirement approaches. If you don’t have a plan, or you’re worried about a pension shortfall, you might be contemplating working longer, saving more, or accepting a lower standard of living in later life.

Seeking financial advice now could make a real difference.

A recent International Longevity Centre (ILC) study found that those who sought financial advice between 2001 and 2006 were on average over £47,000 better off by 2014/16 than those who didn’t. Those regularly seeing an adviser held pension pots 50% higher on average than for those who only took one-off advice.

Get in touch

If you’d like to discuss your retirement plan, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note: A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.